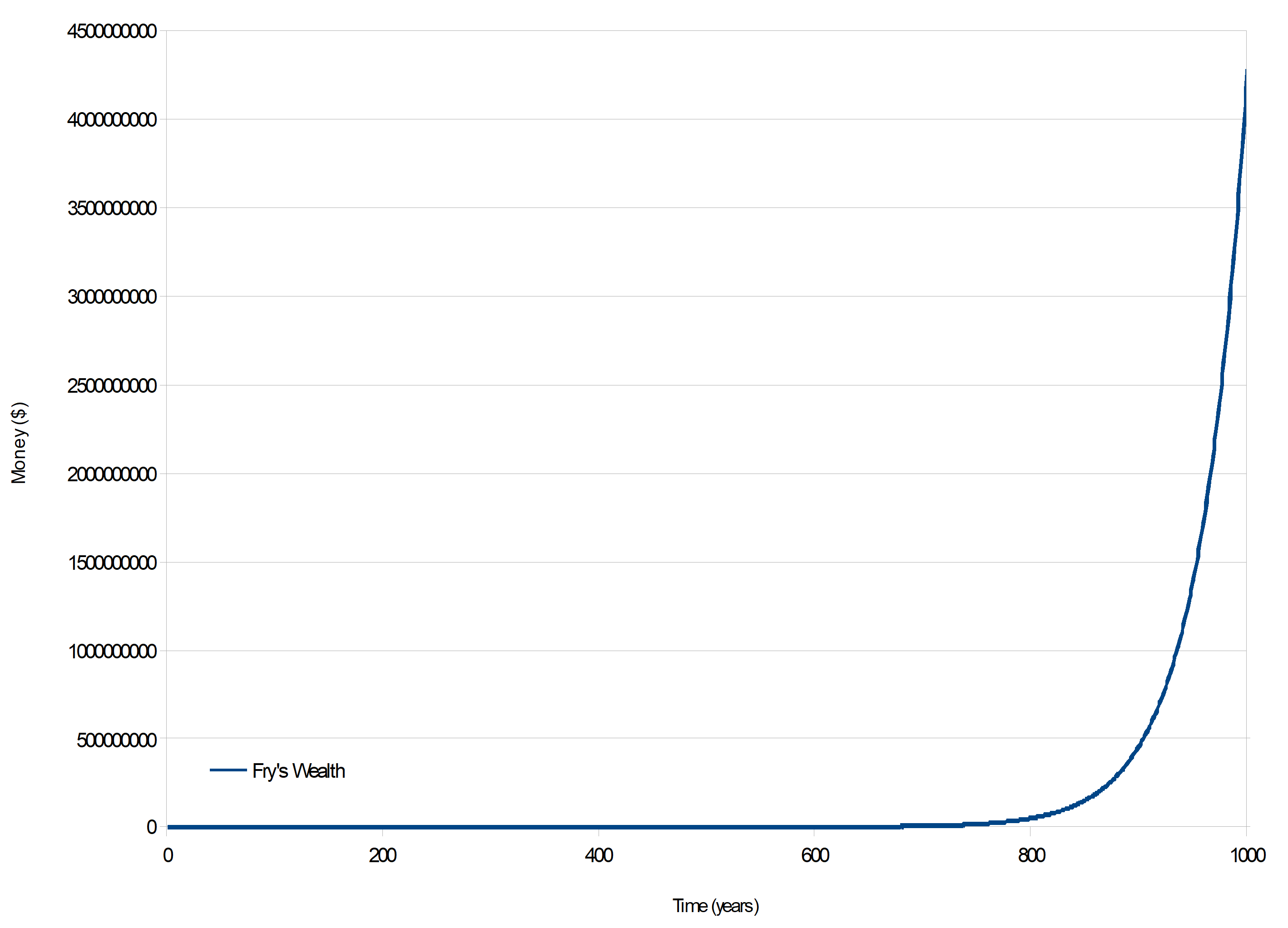

“Ok… you had a balance of $0.93. And at an average of 2.25% interest over a period of 1000 years, that comes to… 4.3 billion dollars.”

If you’ve never seen it, Futurama is a cartoon set in the year 3000. Fry, the main character, finds himself in this future world after having cryogenically frozen himself back in the year 2000.

In the episode A Fishful of Dollars, Fry goes to his old bank to withdraw some money. The bank has kept his account open and his $0.93 balance from 2000 is now worth nearly 4.3 billion dollars after gaining interest at an average rate of 2.25% for 1000 years. The math checks out:

$0.93*1.0225^1000 = $4,283,508,449.71

That’s the power of compound interest: interest on interest on interest means even small amounts can snowball into big amounts over time.

And you don’t need to wait 1000 years like Fry did.

The Cost of Coffee Compounded

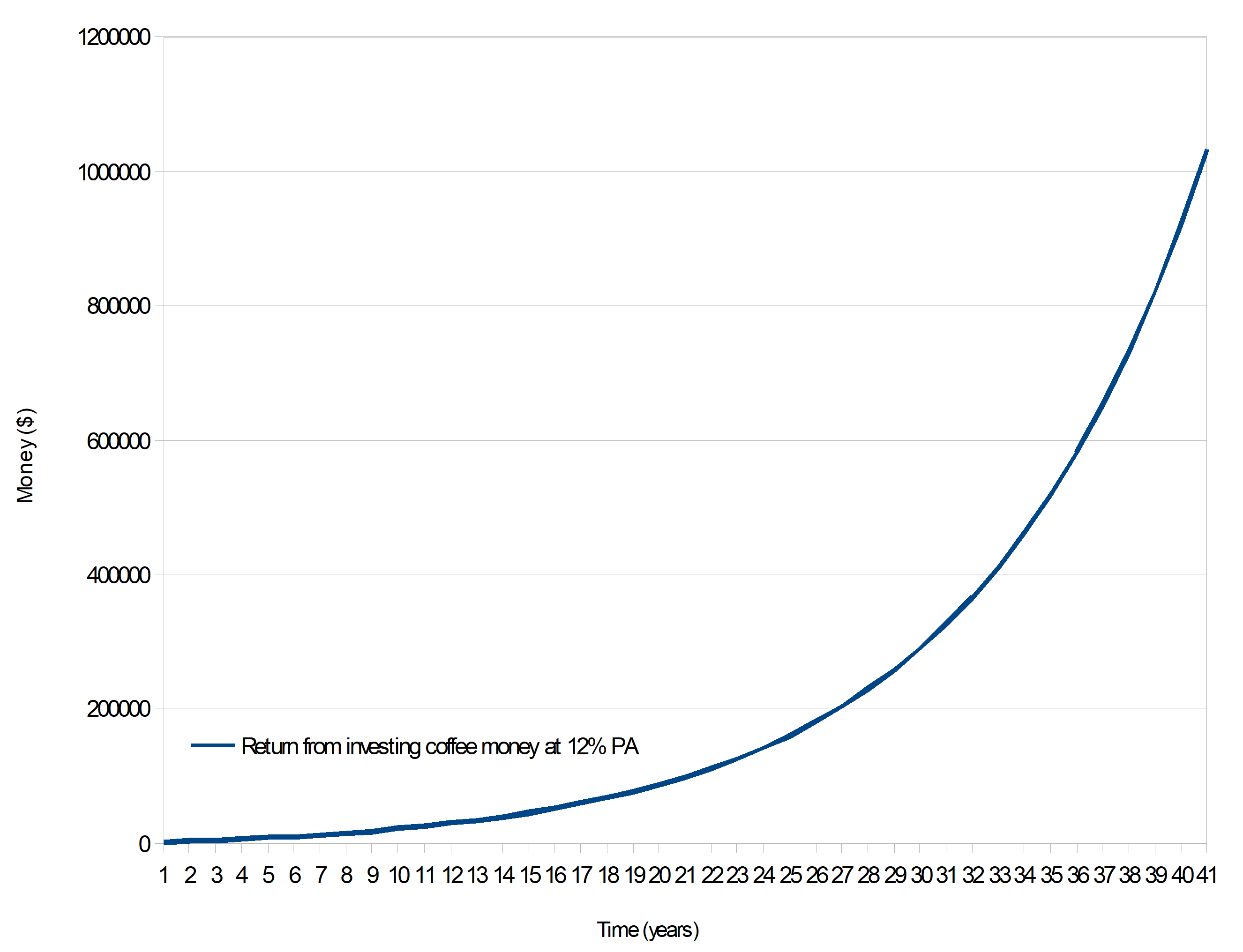

I recently saw a particularly good, real life, and easy example illustrating how to benefit from compound interest. Suze Orman describes how simply forgoing your daily takeaway coffee habit could make you a millionaire:

“Let’s say you spend around $100 on coffee each month. If you were to put that $100 into a Roth IRA instead, after 40 years the money would have grown to around $1 million with a 12 percent rate of return. Even with a seven percent rate of return, you’d still have around $250,000.”

Again, the numbers check out. If you buy coffee every day for about $3.30, that comes to around $100 per month or $1,200 per year. But if instead of buying this coffee (perhaps you make it at home instead) you invested that money and achieved an average 12% annual return, after 40 or so years you would be a millionaire:

So, as Orman says, buying takeaway coffee every day “is like peeing $1 million down the drain”.

Yes, a 12% interest rate is a bit generous – but not totally unrealistic. And even at a more achievable 7%, the small sacrifice of forgoing a takeaway coffee will earn you $250,000 down the line. Imagine how much you could make by giving up a few other luxuries as well!

Visualizing Compound Interest

Compound interest isn’t very intuitive.

It’s like the fact that if you could fold a piece of paper in half 100 times, it would be wider than the observable universe. Without going through the numbers, it’s hard to see how this could be true.

There are three components to compound interest:

- Initial investment

- Rate of return

- Time

And changing any of these figures often significantly changes the final figure.

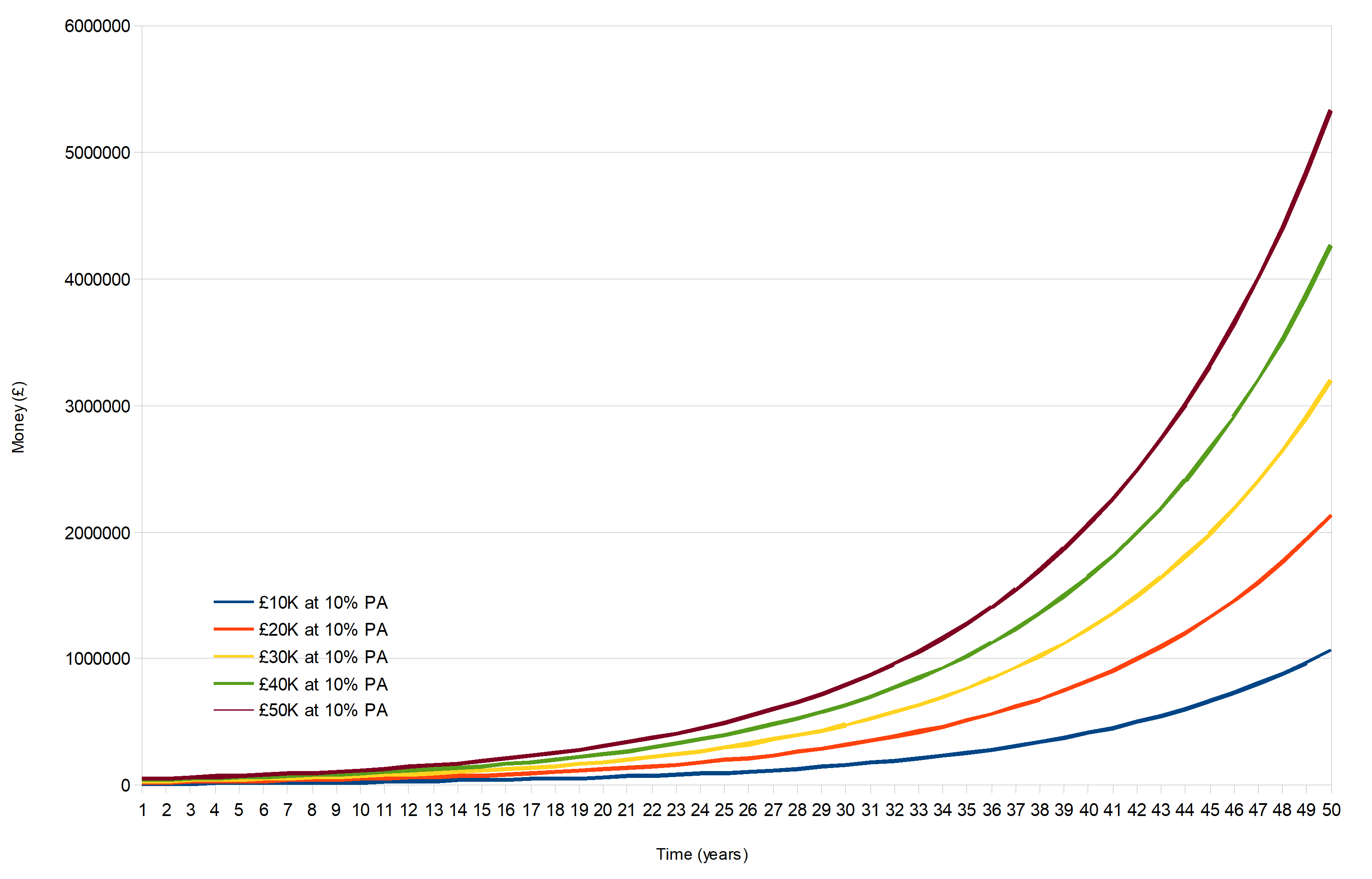

Initial investment

First, the initial investment.

If you invest twice as much to begin with, you’ll end up with twice as much at the end. Even if the difference between £10,000 and £20,000 seems like a lot – the difference will be a lot bigger down the line!

Here, an extra £10,000 at the start is worth an extra £1 million at the end.

The lesson from this is that each pound you save now is worth a lot more in the future. Giving up takeaway coffee as well as, say, making your own lunch instead of eating out will make you far richer than giving up takeaway coffee by itself will.

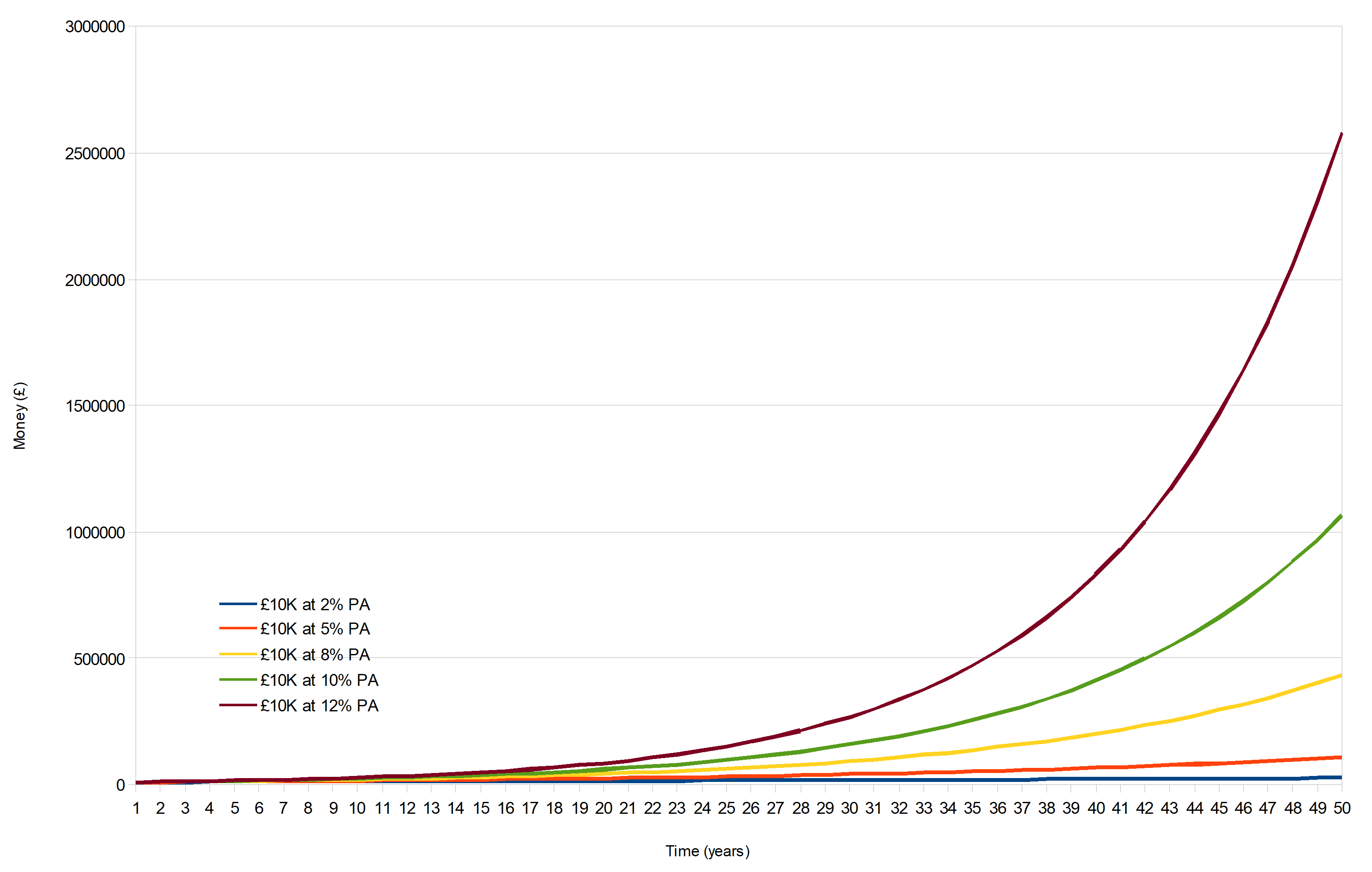

Rate of return

Second, the rate of return.

If you’re only getting 2% a year on your money, you might as well spend it now (unless you have 1000 years to wait like Fry).

But 12% a year – even though it doesn’t sound that exciting in the short term – is huge!

After 50 years, a £10,000 investment at 12% will be worth more than twice as much as a £10,000 investment achieving 10% – despite 12% being only 2 percentage points more than 10%.

The point here is that small changes to the rate of return make huge differences over time. If I’d included 15% annual return in the graph above, the final figure would be over £10 million and it would have completely thrown the graph’s scale off.

Or, to use a more extreme example, if you could get 100% return per year on your £10,000 it would take just 7 years to reach £1 million. After 50 years of 100% returns, you’d have more than £11 quintillion (18 zeroes, or more money than there is on the entire planet).

Anyway, to get a return on your money you have several options, including:

- Bonds

- Equities (stock market)

- Commodities

- Crypto

- Property

- Starting your own business

Each has their pros and cons and it’s a topic for another day what all of these are.

Index tracker funds are a decent benchmark and a simple, low effort, and low risk (over the long term) investment. Instead of trying to pick winning stocks, a tracker fund simply consists of all the businesses in a market (weighted for their market capitalization). So, for example, an S&P 500 tracker fund consists of all the stocks in the US S&P 500 index, a FTSE All Share tracker fund consists of all the stocks in the UK’s FTSE All Share, and so on.

An advantage of these tracker funds is that the management fees are very low. You don’t have to cover some fancy fund manager’s fees because managing the fund is simple: just buy everything. Further, most managed funds fail to beat the market average anyway – especially after management fees are taken into account!

Given this, in his 2013 letter to Berkshire Hathaway investors, famous investor and former world’s richest man Warren Buffett advised investors to put their money in tracker funds:

“The goal of the non-professional should not be to pick winners – neither he nor his “helpers” can do that – but should rather be to own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal […] My money, I should add, is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will. […] My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.”

There are entire books written on this – I personally would recommend A Random Walk Down Wall Street by Burton G. Malkiel.

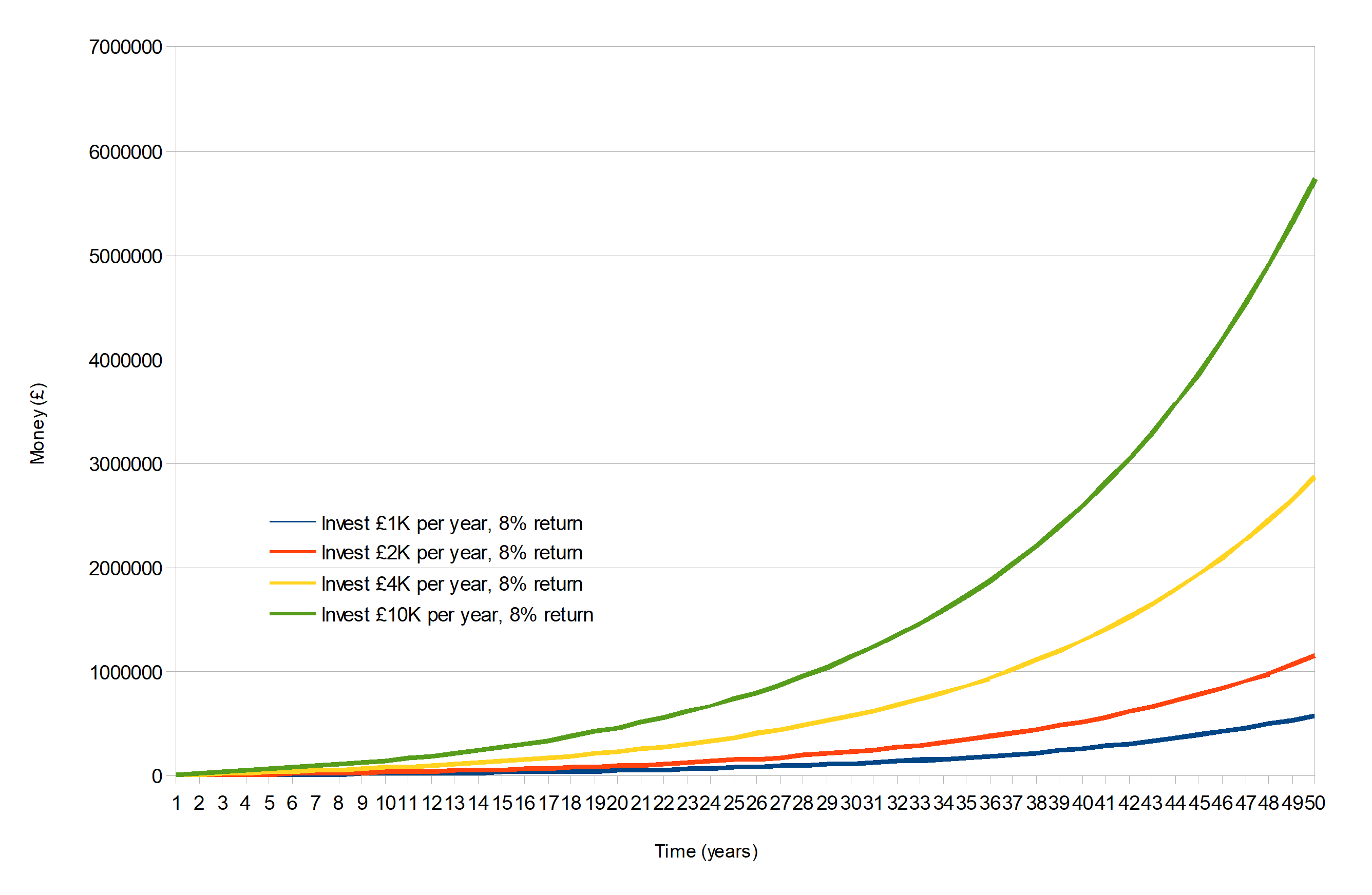

Historically, the S&P 500 has returned on average around 8% per year over the last 50 years. The FTSE All Share is around the same. Of course, these past figures don’t guarantee future gains, but over a long timeframe this 8% per year figure is a realistic expectation for a return from passive investments.

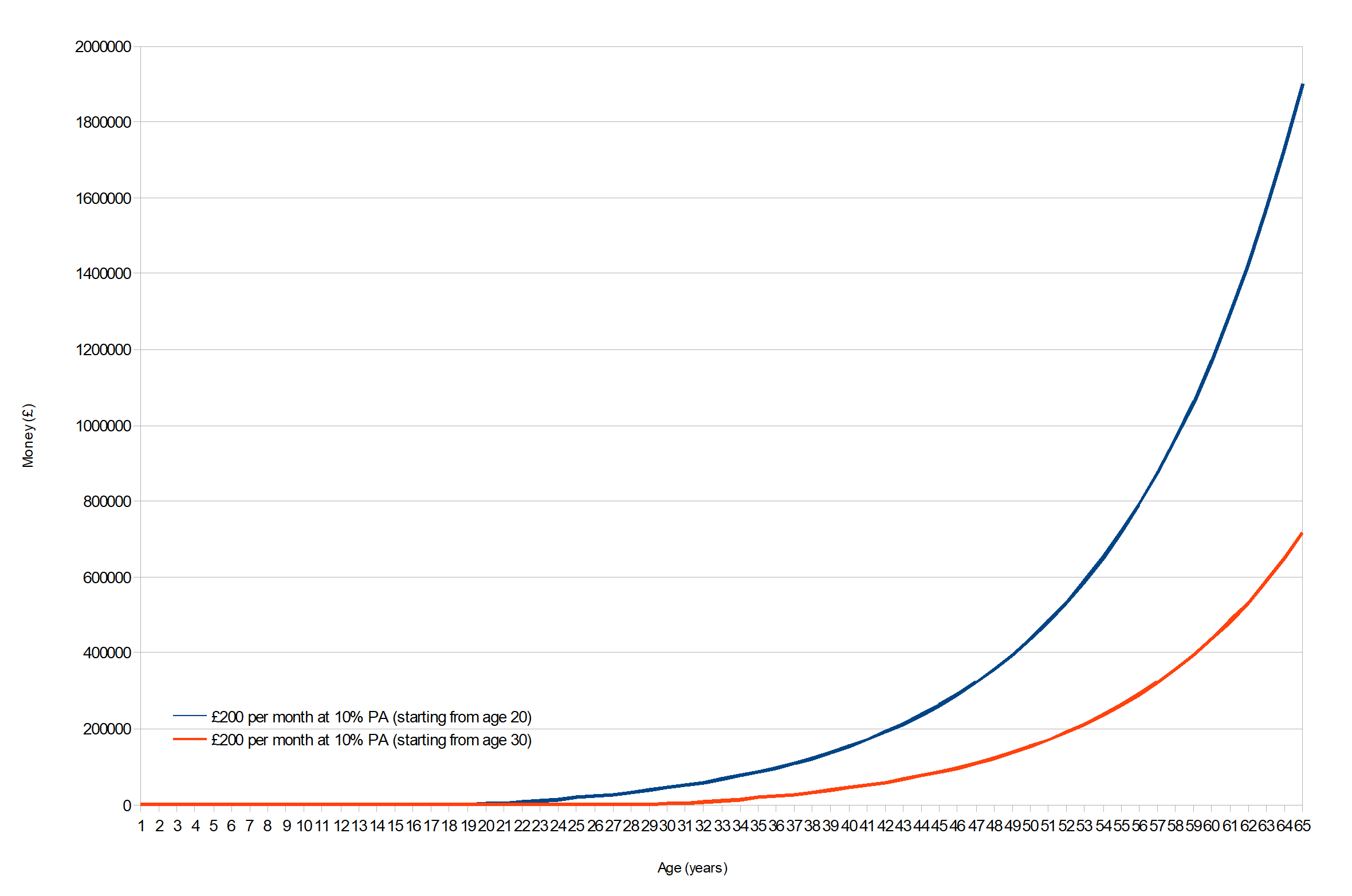

Time

Finally, there is the number of years you let your investment snowball for.

However, unless cryogenic freezing technologies are perfected or some radical anti-aging drug is invented, we can’t significantly change how much time we have. It’s a boring thing to say but I suppose the lesson here is that the sooner you start investing, the better.

Here, two people invest at the same rate (£200 per month/£2400 per year) and get the same annual return (10%). However, by age 65, the person who starts investing at age 20 will be more than £1 million better off than the person who starts investing at age 30 – despite only contributing £24,000 more.

Inflation

An important thing I have missed in all these calculations so far is inflation.

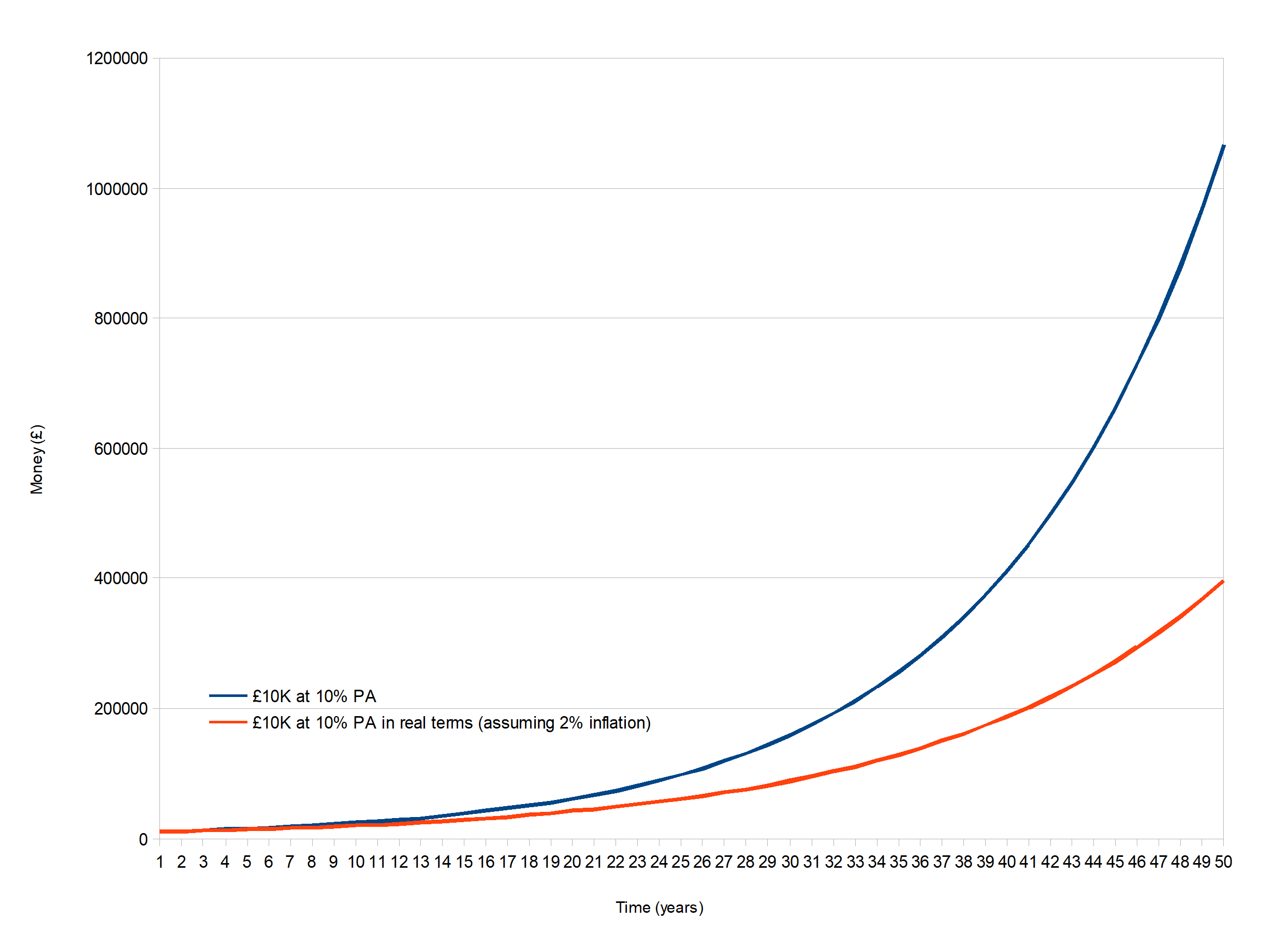

Most central banks have a target rate of around 2% inflation per year and so we have to factor this into our expected returns from compound interest:

Here, 2% inflation means that even though your £10,000 will indeed be worth over £1 million after 50 years of 10% returns, the purchasing power of that £1 million will be more like £400,000 in today’s terms – still a lot of money!

Get Rich Slow

Compound interest is not a get rich quick scheme. It’s a get rich slow scheme.

All the good gains come towards the end. Returning to Futurama, the graph of Fry’s wealth looks like this:

Fry had to wait a long time before making any decent amount of money. After 100 years of waiting, Fry would have had less than $10. He had to wait 625 years to make his first million.

But even without 1000 years to wait, it’s still possible – easy, even – to use compound interest to your advantage. Pretty much everyone can invest significantly more than Fry’s $0.93. And many many investments reliably yield more than 2.25% per year.

Compound interest is such that if you’re young, and consistently and patiently play the averages, you’re pretty much guaranteed to become a millionaire.

“Every gold piece you save is a slave to work for you. Every copper it earns is its child that also can earn for you. If you would become wealthy, then what you save must earn, and its children must earn, that all may help to give to you the abundance you crave […] learn to make your treasure work for you. Make it your slave. Make its children and its children’s children work for you.”

– From The Richest Man in Babylon by George S. Clason