This coronavirus pandemic is the biggest news story of my life.

The whole thing feels like living in a movie. The entire world is pretty much on lockdown. And it’s not over yet.

It’s an extraordinary time to be alive. This event and its effects are so monumental that it’s hard to imagine things ever going back to normal.

They will, though, of course. This virus will pass and we will carry on. But the new normal is likely to be quite different from what it was before Covid-19.

Less globalization

Even before Covid-19, there was growing dissatisfaction with globalization.

The UK’s 2016 vote to leave the European Union and President Trump’s ‘America first’ trade tariffs are the most obvious examples of this, and similar policies were gaining support elsewhere in the world prior to Covid-19.

But the coronavirus outbreak has necessitated a rapid shift to extreme protectionism to try and control the spread of the disease.

At first, countries started testing and quarantining passengers arriving from infected areas. Then countries started banning flights from mainland China. Then other infected countries. Now, at the time of writing, pretty much all commercial flights are cancelled.

Even the European Union is pulling up the drawbridge. As well as the EU closing the borders to people from non-EU countries, countries within the EU are restricting travel from other EU countries. France and Germany have banned export of protective face masks, despite EU health ministers urging cooperation.

All these measures are only temporary, of course. But the coronavirus pandemic has drawn attention to the disadvantages of being overly reliant on global supply chains.

“In any case, factory closures and production suspensions are already disrupting global supply chains. Producers are taking steps to reduce their exposure to long-distance vulnerabilities.”

It’s not just disease that poses a threat to global supply chains. If your supply chain is dependent on parts from multiple different countries, then any number of things in those countries can disrupt it: political instability, natural disasters, war, trade tariffs, travel restrictions, and so on. This crisis has drawn attention to these risks.

For many businesses, though, these risks will still be worth the cost savings post-corona. But governments can’t afford to be so complacent.

The story of France and Germany hoarding their own protective face masks above is a prime example of this. Cooperation is all well and good when things are going well, but it’s only natural for governments to prioritise their own citizens when times get tough. I’d even go as far as to say it would be wrong for them not to in a crisis.

The US Government has had a similar realization recently with regards to US dependence on China for medicine.

“Right now, we have virtually no capacity in the United States to make even basic drugs for treating coronavirus, or antibiotics for infections that may come with it, including bronchitis or pneumonia… And now we’ve got a perfect storm of a production shutdown in China and a disease outbreak there, where they need medicines for their own people, coupled with rising global demand on that same global supply source… This is a wake-up call.”

– Rosemary Gibson, Hastings Center bioethics research institute

Realising this vulnerability, US lawmakers are already proposing legislation – the Securing America’s Medicine Cabinet Act (SAM-C) – to reduce dependency on foreign providers and increase domestic drug production.

The situation reminds me a bit of blockchain vs. centralized databases. It’s way more efficient to use a centralized database rather than thousands of decentralized nodes, but way less secure. Similarly, it’s less efficient for each country to manufacture their own goods separately, but it’s far more secure.

The Covid-19 pandemic suggests that – at least in some key areas – the push for greater efficiency has come at the expense of reduced security. Going forward, many countries and businesses might seek to redress this balance.

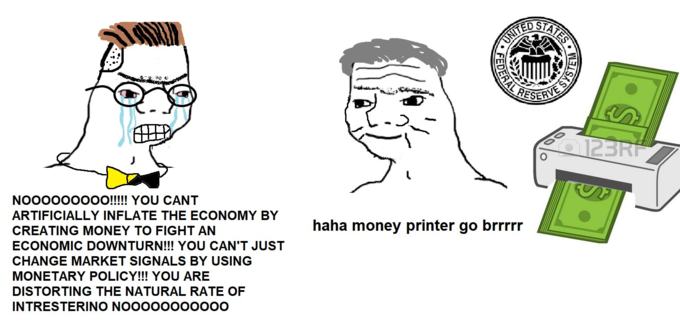

New fiscal and monetary paradigms

We were already in weird economic times even before Covid-19.

The quantitative easing and extremely low interest rates that followed the 2008 financial crisis were unprecedented at the time, but soon became the new normal. And yet despite this unprecedented monetary environment, economic growth has been pretty weak since 2008.

So central banks kept interest rates at near-zero, but this left them little room to manoeuvre in the event of another downturn. Now we’re in such a downturn, things look like they could get a lot weirder.

On 16th March, the US Federal Reserve set a new target interest rate of 0-0.25% and announced a $700bn stimulus package. But instead of pumping as you might expect, US stock markets responded to these measures by dumping even more than they already had done.

To make matters worse, there were signs of strain in the financial world even before Covid-19. Back in September 2019, the New York FED had to step in when repo rates quadrupled overnight. And last week, the New York FED offered $1.5 trillion (with a T!) of repo just to keep the whole thing from falling apart.

Central banks everywhere are slashing rates and printing money like never before. On 19th March, for example, the Bank of England cut rates to 0.1% (down from the already reduced 0.25% rate set a week earlier) and announced £200 billion in stimulus. The same day, the European Central Bank announced a €750bn stimulus package.

But these measures are unlikely to be enough to get things going again – so where do central banks go from here?

One option is negative interest rates. Denmark, for example, has had negative rates for a while now and their economy seems to have been functioning pretty normally. But there’s a limit to how negative rates can go, and if that’s not enough the only other option is further stimulus.

It looks like the Federal Reserve is probably going to print a ton of money – much much more than in 2008.

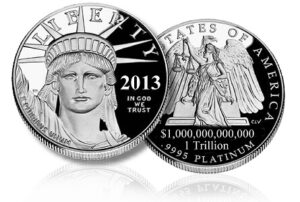

There’s even talk of the US Treasury itself issuing new currency instead of borrowing from the Federal Reserve.

And the treasury has the power to do this. The idea of minting a trillion dollar coin to avoid further borrowing (and surpassing the ‘debt ceiling’) was floated back in 2011. Now, representative Rashida Tlaib is proposing the Treasury mint two $1 trillion platinum coins to fund spending during this crisis. These coins would simply be deposited in the Treasury’s account at the Federal Reserve instead of further borrowing.

The whole discussion reminds me of that episode of The Simpsons where Mr Burns steals the trillion dollar bill. It was parody back then, but it’s coming close to reality now.

But however the new money is created, this stimulus is likely to give rise to radical fiscal policies. There was already a bit of so-called ‘helicopter money’ in the US in 2008, but recent proposals – from both Republicans and Democrats – suggest we will be seeing a lot more this time around.

On 16th March, senator Mitt Romney proposed giving every American adult $1000 “to help ensure families and workers can meet their short-term obligations and increase spending in the economy”.

Then on 17th March, Treasury Secretary Steven Mnuchin reportedly proposed a $1 trillion stimulus package that would involve sending checks to everyone in the country.

And on 18th March, House Financial Services Committee Chair Maxine Waters set out a series of quite radical proposals to help the economy that includes:

Giving every adult $2000 (and $1000 for each child they have) every month for as long as this crisis continues

Giving every adult $2000 (and $1000 for each child they have) every month for as long as this crisis continues- Suspending all credit payments for individuals and small businesses (e.g. mortgages, personal loans, student loans, car payments, small business loans)

- Using the Federal Reserve to reimburse all creditors affected by the measure above

This crisis has pushed quite extreme fiscal measures to the fore. Obviously these measures are a response to these extreme times but, if they work, fringe policies like universal basic income (UBI) will be accelerated into the mainstream – especially if unemployment remains high.

Remote working

Covid-19 has already caused huge changes to the workforce.

Entire industries, such as tourism and hospitality, have seen revenues drop significantly overnight. This has caused significant job losses already, with more likely to follow.

But many of those still employed will already be experiencing a significant change to their working day: Working from home.

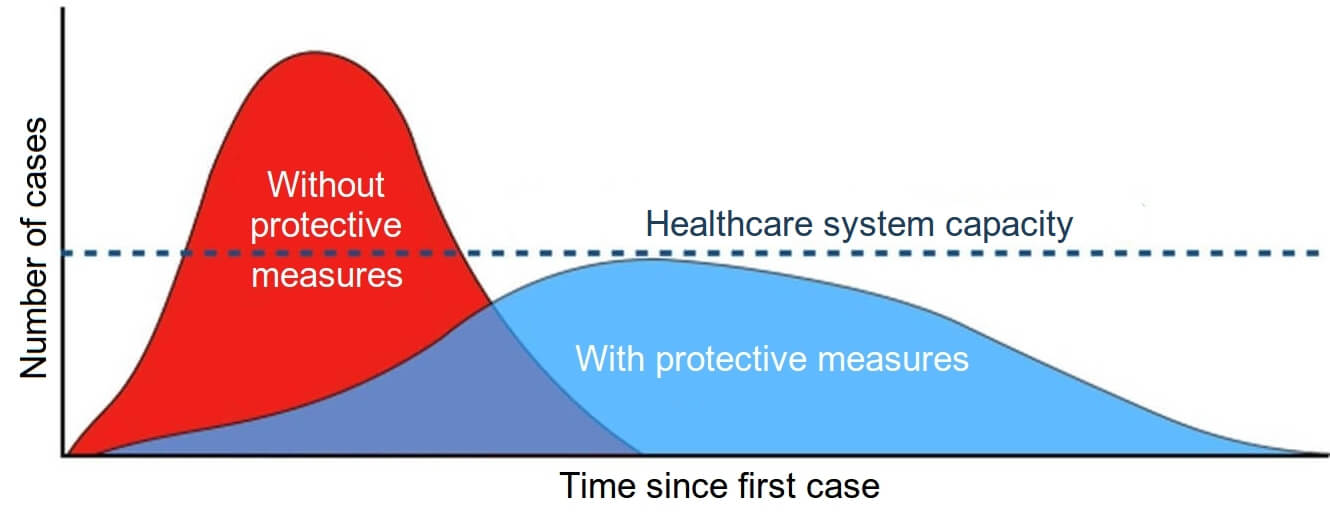

Without policies of ‘social distancing’ and ‘self-isolation’, compound growth would cause an extremely sharp rise in Covid-19 cases that could overwhelm the health system. So, anyone who can work from home is strongly being encouraged to do so.

And it turns out a lot of people can do their jobs from home.

If your job involves spending a lot of time at a computer – and let’s face it many do nowadays – then it probably doesn’t matter where that computer is, as long as the same work gets done. And if you do need to speak with people or hold meetings, videoconferencing tools such as Zoom and Skype are surprisingly effective at creating the feeling of being in the same room together (once you get used to them). Plus, cloud computing and collaboration tools make it possible for employees to work together on projects regardless of location.

This trend towards remote working was already taking place before Covid-19, but the pandemic will surely accelerate it dramatically.

And remote working makes a lot of sense – both for employees and employers. Employees get to do their work in a nicer environment and won’t waste so much time and money commuting to and from the office every day. Parents who work from home can look after their children if necessary, and save on childcare costs. For employers, there is evidence that remote employees are more productive and less likely to leave the company. Then there are the potential cost savings that can result from cutting down on office space.

An increase in remote working could have further the effect of reducing housing demand in major cities such as New York, San Francisco, and London. Obviously people will still find such areas desirable, but a big part of the pull of these major cities is the job market. If people no longer need to live in these cities to work for the companies that are based there, they may opt to live further out to benefit from lower housing costs and more space.

Proper preparation

People have been warning for years that a pandemic like coronavirus could happen. And now that it has, it’s shown how badly prepared we were. Going forward, the memory of Covid-19 will motivate action to prevent and better prepare for future pandemics – at a national, international, and individual level. Perhaps this experience will motivate action to more seriously consider other emergencies too, such as blight and natural disasters.

Specifically, governments and health authorities will dedicate far more resources to pandemic preparation. They will gain valuable experience for modelling disease spread and learn which tactics are the most effective for minimizing disruption and, most importantly, saving lives.

But ultimately it is down to individuals to prevent the spread of disease. People will remain acutely aware of the importance of hygiene measures such as washing their hands. Even after the pandemic passes, it’s likely some people will think twice before going in for a handshake. These new buzzwords – social distancing and self isolation – will surely come to many people’s minds next time they get ill, as will their responsibility not to infect vulnerable people.

As for preparation, the panic buying we’ve seen during this outbreak will encourage individuals to more seriously consider worst case scenarios.

As for preparation, the panic buying we’ve seen during this outbreak will encourage individuals to more seriously consider worst case scenarios.

The paranoia of ‘preppers’ has been somewhat vindicated by this whole episode. It might look kind of crazy stacking tons of tins of beans in preparation for the worst, but if you think about it it’s actually pretty rational. In poker terms, prepping has great pot odds: It costs very little to do, but pays off big if you win. Or to put it another way: it’s better to prepare and not need it than to not prepare and need it.

Panic buying is selfish, but prepping is not. You could even make the case that prepping is actually selfless: If more people took personal responsibility to prepare in good times, then more food (and toilet paper) would be on the shelves for vulnerable people in the bad times.

Life after Covid-19

As terrible as the coronavirus outbreak is, there are reasons to be positive.

Setbacks like this also present huge opportunities. Interest rates are low and basically every investment is on sale at the moment – especially stocks and crypto. Perhaps more importantly, a lot of businesses are going to go under during this time, but the demand will still be there when things get back on track. Those who seize on this demand will create new businesses and new jobs and rebuild the economy to new heights.

But for the time being, pubs, restaurants, and shops are out of the question. However, this means people are spending more time outdoors and in nature – or at least it seemed that way at the beach yesterday.

Anecdotally, it even feels as though people are being kinder to one another. As I walked along the beach (at a safe distance of course!) yesterday, people would smile and nod where before we would just ignore each other. And personally, I’ve been using this time to call people I haven’t spoken to in a long time – I’m sure many others are doing the same. Despite social distancing, this crisis is bringing people together in other ways.

Quarantining and lockdowns also mean an opportunity to spend time with family and loved ones. And with everyone stuck at home without much else to do, we could see a lot of new babies born around Christmas time!

There are even environmental benefits to the coronavirus pandemic. Reduced travel and economic activity mean air pollution and CO2 levels have fallen dramatically.

Further, the world will also emerge from this chapter much better prepared for future pandemics – and these future diseases might be far more dangerous than Covid-19.

So while these are dark times – the most difficult in decades – there are real reasons to be positive. Now is a great time to reflect on what’s important in life and look to the future to make it better. Quarantines and lockdowns are the perfect time for self-improvement, learning, planning, and strategizing. Coronavirus is going to dramatically shake things up and this will create opportunities to rebuild bigger and better and stronger than ever before. I’m genuinely excited for life after Covid-19.

Wrong! Coronavirus is a global Pandemy, WHO has confirmed it’s extremely deadly but it was downplayed soon by pseudo-scientists.

You should remove your first lines “Edit: I have since written an update on this topic, which you can view here. ….”

Since your edit is totally wrong and your initial description

“Without policies of ‘social distancing’ and ‘self-isolation’, compound growth would cause an extremely sharp rise in Covid-19 cases that could overwhelm the health system. So, anyone who can work from home is strongly being encouraged to do so.”

was totally right.

Just remove your edit part, it’s misleading and scientifically wrong what u updated, bro!

It will be very important to get vaccinated and I hope, it will give rewards of 10k USD for everyone who will get vaccined. Paid out in Bitcoin.