Last year, billionaire investor Peter Thiel sold off most of his remaining stake in Facebook. Around the same time reports emerged that Founders Fund, Thiel’s venture capital firm, bought millions of dollars worth of Bitcoin.

At first, these two moves might seem unrelated. But a recent interview sheds light on how this fits with his predictions for the future.

“We should ask this question: is [the future] really going to be ever more centralization, or could it go the other way?”

I’d never thought of blockchain and artificial intelligence (AI) as competitors. It’s easy to imagine both these technologies making progress without stepping on the other’s toes.

But Thiel characterizes them as being representative of two mutually exclusive visions for the future: centralization and decentralization.

When framed in this way, it raises a question of which vision will emerge victorious. Will increasingly intelligent AI systems concentrate power into the hands of those who control them? Or will blockchain win out and distribute decision making more democratically? Will technology make the future more centralized? Or more decentralized?

The two sides: crypto vs AI

The decentralization trend is exemplified by the rise of cryptocurrency, distributed ledger and blockchain technology.

Bitcoin was created in 2008 as the world’s first decentralized currency. But the underlying technology – blockchain – is now being put to all sorts of uses beyond this.

Ethereum, for example, is designed as a generic blockchain that can be programmed to do just about anything.

“The Ethereum client […] will include a built-in peer-to-peer network for sending messages and a generalized blockchain with a built-in programming language, allowing people to use the blockchain for any kind of decentralized application.”

In contrast to the decentralizing power of blockchain, there has been a trend toward more centralization in many areas:

- Larger governments (e.g. the European Union, expansion of the US Federal Government and budget)

- Larger cities (e.g. London, New York, San Francisco)

- Larger companies (e.g. Google, Amazon, Apple)

- Larger databases (e.g. Facebook)

Today, the specific technology most associated with this trend toward centralization is artificial intelligence.

AI is a bit of a buzzword at the moment. People use it to refer to all sorts of things. So to be clear, we’re not talking about future technologies with human-like versatility across a broad range of domains. We’re not talking about the Terminator or HAL 9000. So-called artificial general intelligence (AGI) of this kind might be a long way off.

The AI that’s used today is most powerful in the domains of big data and machine learning. And this represents a powerfully centralizing force rather than a decentralizing one.

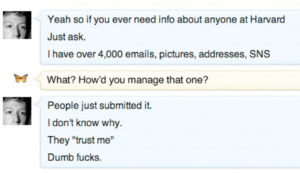

Facebook is perhaps the best example of this. Its centralized databases hold an ever-growing amount of personal infomation and data. Their machine learning algorithms are able to guess your political affiliation, your sexual orientation, whether you use drugs and a whole load of other things with alarming accuracy. As Thiel remarks: “it’s like the God of St. Augustine […] it knows more about you than you know about yourself.”

Personal data and privacy

In the last decade or so, the omniscient power of big data and machine learning has meant tremendous growth for organisations that have used them effectively.

Social media companies, for example, have leveraged their enormous databases to fine-tune algorithms to manipulate human reward systems. People talk about being addicted to social media – and that’s exactly what it’s been designed to do.

Social media companies, for example, have leveraged their enormous databases to fine-tune algorithms to manipulate human reward systems. People talk about being addicted to social media – and that’s exactly what it’s been designed to do.

Yet for all this dopaminergic stimulation, there are signs the tide is turning. Facebook, the largest social network of them all, is faltering despite its colossal centralized database and AI systems.

Firstly, engagement on the platform is down. People are spending less and less time on there. They’re also sharing less, commenting less and liking less.

But the biggest blow to Facebook – and the centralizing force it represents – has been the Cambridge Analytica scandal.

As many as 87 million Facebook users’ personal information was obtained without their permission by a third party. This data was then used to create psychographical profiles which could be used to target and manipulate users for political gain.

It’s every privacy advocate’s worst nightmare. Not only had Facebook users’ personal data been leaked, but this data was then being used against them. The whole episode brought concerns about misuse of personal data to the fore in the most dramatic way imaginable.

Facebook CEO Mark Zuckerberg appeared before the US Senate and the European Parliament in an attempt to quell these concerns. He published an apology letter. New privacy policies were being drafted. Extra steps would be taken to protect data. But it was all too little too late.

Facebook CEO Mark Zuckerberg appeared before the US Senate and the European Parliament in an attempt to quell these concerns. He published an apology letter. New privacy policies were being drafted. Extra steps would be taken to protect data. But it was all too little too late.

Zuckerberg was already seen as an evil, lizard-like nerd and the whole Cambridge Analytica scandal only cemented that reputation. It wasn’t quite bad enough to completely destroy the platform, but it’s a severe blow to Facebook’s future growth ambitions. Any new machine learning or creepy AI will be met with intense scrutiny from both users and regulators. More than that, though, the public no longer trust Facebook to ensure their privacy.

And on the issue of privacy, crypto is the antithesis of Facebook.

Facebook requires users to trust them with their data. But crypto is trustless. Bitcoin, for example, is so private that its first major use case was purchasing drugs online without getting caught. Anyone can generate a Bitcoin or Ethereum wallet offline and no one need ever know who the owner is. If anything, crypto is too private.

So, for better or worse, decentralized technologies like Bitcoin promote privacy. But centralized technologies like Facebook threaten it.

Censorship and democracy

Another big feature of blockchain is censorship resistance. The decentralized nature of the technology makes it practically impossible to change or delete information once it’s recorded on the ledger. If you tamper with one node, there are still thousands of others that won’t be censored.

Unsurprisingly, authoritarian governments hate crypto. China, for example, has taken all sorts of steps to try and ban it.

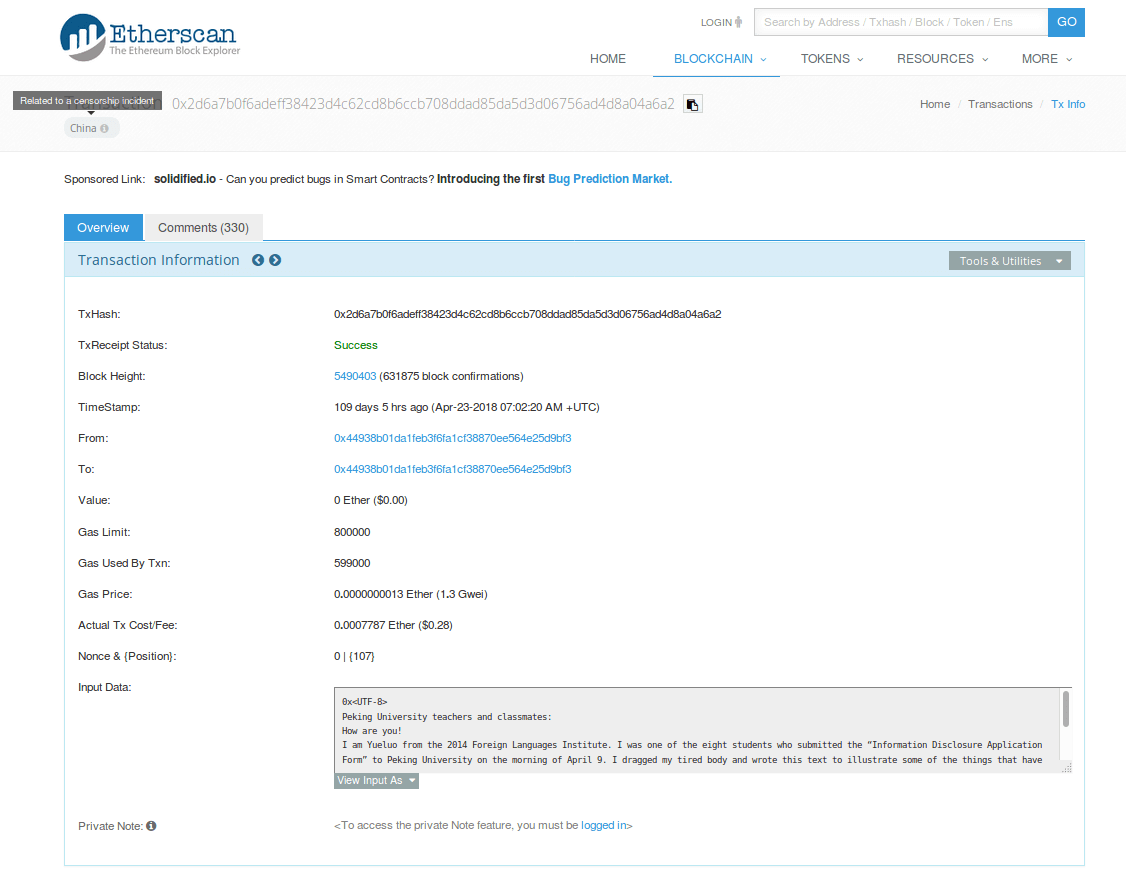

But despite these efforts Chinese citizens are still using blockchain to circumvent government censorship.

Gao Yan was a student at Peking University who committed suicide in 1998 after claiming to have been sexually assaulted by a professor. Earlier this year another student, Yue Xin, published an open letter related to this case. It began circulating on WeChat, Weibo and other Chinese social media platforms under the hashtag #MeToo but it wasn’t long before these posts were taken down by government censors.

However, on April 23rd, an Ethereum address sent a value of zero Ether to itself. The metadata for this transaction contains the text of Yue’s letter – text which is now stored on the Ethereum blockchain forever. Unlike the posts on social media, it can’t be removed by the Chinese government.

You can view this transaction here.

But while decentralized technology is being used to circumvent censorship, centralized technology is being used to enforce it.

Just last week, YouTube, Facebook and Apple banned Alex Jones and Infowars from their platforms and removed his content.

Regardless of whether you think the ban is justified, it is censorship. The decision makers at these companies decided to remove Alex Jones from their platforms, and they did. They control the platforms and they have the final say over who can use them. With centralized technology, the decision making power is concentrated among a small number of individuals.

The same can’t be said of decentralized platforms.

Despite creating Bitcoin, Satoshi Nakomoto couldn’t steal or freeze wallets or reverse transactions even if he wanted to. Blockchain doesn’t work like that.

In 2016, when vulnerabilities in the DAO code on the Ethereum blockchain allowed users to siphon off ether, no single individual could reverse these transactions. The whole Ethereum blockchain had to be hard forked – but only after it had been put to a democratic vote among all the users.

Ideological lines

These characterizations of blockchain as democratic and anti-censorship on the one hand and AI as authoritarian and pro-censorship on the other fit with another of Thiel’s claims:

“Crypto is decentralizing, AI is centralizing. Or, if you want to frame it more ideologically, crypto is libertarian and AI is communist […] AI is communist in the sense that it’s about big data. It’s about big governments controlling all the data – knowing more about you than you know about yourself. So a bureaucrat in Moscow could, in fact, set the prices of potatoes in Leningrad and hold the whole system together.”

Ever since Bitcoin was created it’s been associated with libertarian and anarchist ideology. It’s anti-government and pro-freedom. But what about AI?

A perfect AI is the communist dream.

This centralized source of knowledge could perfectly coordinate the economy from the top down. It could ensure that just the right amount of each product would be produced to satisfy the needs of citizens. It’s the answer to Engels’ question of how to ensure we “shall not go hungry in regard to corn and meat while we are choked in beet sugar and drowned in potato spirit.”

But there’s a dark side to this utopia.

An omniscient AI would also have perfect knowledge of the citizens. It would know where they are, what they’re doing, what they’re thinking.

And if you think this sounds hysterical, just look at Facebook. We’ve already seen how it can guess your political affiliation and sexual orientation. Imagine what other creepy things it knows about you. Same with Google. The Soviet era KGB would have loved that kind of power.

And if you think this sounds hysterical, just look at Facebook. We’ve already seen how it can guess your political affiliation and sexual orientation. Imagine what other creepy things it knows about you. Same with Google. The Soviet era KGB would have loved that kind of power.

And so does communist China. The Chinese government loves AI as much as it hates crypto.

It’s no secret that China is investing heavily in AI. And these new technological developments are being used by the Chinese government to more efficiently censor online communications. Machine learning algorithms are becoming increasingly adept at shutting down dissenting opinion. Messages relating to the Tiananmen Square Massacre or leaving the communist party, for example, “simply disappear.”

And as AI systems become more powerful, the situation is only going to become more like Orwell’s 1984. Facial recognition systems are popping up all over the country and in all sorts of places. And they’re going to become more accurate as they’re fed more data. Is it really that far-fetched to imagine this technology being used to punish thought crime in the future?

AI is a powerful tool. It has the potential to change the future dramatically – for the better or for the worse. And its centralized nature means this power rests entirely in the hands of those who control it. Depending on who’s in charge, AI could be used to create a communist utopia or an authoritarian dystopia.

Toward geographic decentralization?

The centralization vs. decentralization question goes beyond which technology will emerge victorious. We can also ask whether or not the future will be more geographically decentralized.

Like with technology, the prevailing story over the last few decades has been one of increasing centralization. Big cities – London, New York, San Francisco – have grown far more quickly compared to rural areas.

It’s kind of a snowball effect. If you wanted to get a job in tech, say, you moved to San Francisco because that’s where all the big technology companies are. And if you wanted to start a tech business, you’d do it in San Francisco because that’s where all the employees and capital are. As your business grows and you need to hire more employees, this attracts more tech-minded people to move to San Francisco for work.

These network effects are powerful. But the costs are starting to outweigh the benefits.

“And even though there are these network advantages that you have in a place like Silicon Valley, or that you have in the big cities, they also have some costs and some disadvantages […] You have a tax that comes with it.”

This tax is a financial one. As more and more people move to big cities, increased demand for property pushes prices up.

Here in London, for example, tenants spend just under half (49%) of their gross salary on rent. And when you consider that even the UK basic rate of tax is 20% – not to mention national insurance or student loan repayments – this implies many people are spending much more than half their net salary on rent. At what point do these costs start to outweigh the benefits? Or have we already passed that point?

Here in London, for example, tenants spend just under half (49%) of their gross salary on rent. And when you consider that even the UK basic rate of tax is 20% – not to mention national insurance or student loan repayments – this implies many people are spending much more than half their net salary on rent. At what point do these costs start to outweigh the benefits? Or have we already passed that point?

We’re already seeing signs of a shift away from geographical centralization. Thiel himself has recently moved from Silicon Valley to Los Angeles. He’s also complained how as a venture capitalist a large proportion of his investments just go straight to landlords.

“As a venture capitalist I often think that almost all the venture capital money I’m investing is going to urban slum lords in the form of incredibly onerous commercial leases and of course the fairly high salaries you have to pay people in Silicon Valley which they have to then pay as rent to their landlords.”

Thiel also points to the example of Y Combinator; Silicon Valley’s most prominent startup accelerator. Before, people would go there for 3 to 6 months and then stay on in San Francisco to grow their business. Today, though, the trend is to go back to where you came from after the program has finished.

Then there’s the blockchain companies. The Ethereum foundation, for example, isn’t based in Silicon Valley. It’s not even based in the USA. Instead, it’s based in Zurich, Switzerland – as are many other crypto startups.

And what about Bitcoin? No one even knows who created it, let alone where this person came from.

You can point to all sorts of other examples against this centralization trend. A growing number of companies are moving to places like Chicago and Dallas. Telecommuting is on the rise. More and more people are becoming ‘digital nomads’.

Even technology itself can be said to be driving a trend toward geographical decentralization. As more of our lives are spent online, physical location becomes less important. Tools like virtual reality are just another step in that direction.

So, will the future be more decentralized?

It’s hard to give a general answer. The geographical question illustrates the many dimensions in which this centralization vs decentralization debate can take place besides technology.

But in recent history the trend has been one of almost unanimous centralization. The big tech success stories of the last decade – Google, Facebook, Amazon – are all heavily biased towards AI and centralization. Governments have tended to get bigger, not smaller. As have the major cities.

However, there are reasons to be bearish about a continuing trend toward further centralization.

“My contrarian bias at this point would be to bet on decentralization because the pendulum is so far in one direction I tend to think it can only go the other way.”

The AI revolution went largely unnoticed for a long time. People expected AI to be killer robots – not Google and Facebook. But as people become more aware of how this technology is actually being used – to serve them adverts and manipulate their opinion – there is growing opposition. It’s not just Cambridge Analytica or toothless concerns about privacy. In the European Union, for example, the General Data Protection Regulation (GDPR) represents a serious regulatory obstacle to the continued growth of these technologies.

That said, crypto is still the underdog.

For all the hype it received last year, crypto is far from mainstream. 40% of Americans haven’t even heard of Bitcoin. Only around 5% actually own any.

Bitcoin is still shaking off its reputation as a tool for drug dealers and money launderers. And for all its potential, it’s hard to see what Ethereum has been used for so far besides ICOs – many of which have justifiably been labelled as scams. Blockchain is slow. It’s complicated. It’s unregulated. No one actually uses it for anything.

But these criticisms remind me of early criticism of the internet.

The early internet was too complicated to be inhabited by anyone but the biggest nerds. People scoffed at the idea of buying things online – let alone using it for something as sensitive as banking. And remember how slow dial-up was?

Blockchain developers are well aware of current limitations. But like the internet in 1995, there are millions of potential use cases – many of which haven’t even been thought of yet. Smart contracts alone have the potential to disrupt entire industries. Decentralized technology still has a long way to go.

“I think it’s always a question of human choice […] We talk ourselves into these stories – that [the future] is going to be centralized or decentralized. Today the dominant story is one of further centralization. I think it’s a much more open question. We’re not at the end of history.”

Will the future be more decentralized?

I would certainly prefer a more democratic, private and secure future. I’d feel far more comfortable knowing decentralized technology exists to keep centralized power in check.

But the future is not some movie we passively watch unfold before us. The more important question is: which technology do we want to shape the future?

For more Peter Thiel, check out my review of his book, Zero to One.